The Santa Claus rally phenomenon was defined by analyst Yale Hirsch, who is also the author of The Stock Trader's Almanac. But make no mistake, it is not necessarily truncated to just the aforementioned seven days. Historically, the Santa Claus Rally usually kicks off the day after Christmas, but it can start earlier, such as mid-December. According to The Stock Trader's Almanac, the Santa Claus rally is a perfect example of a seasonal phenomenon.

What does the historical data show?

From December 1, 2021 to January 4, 2022, the Santa Claus rally caused the S&P 500 Index to rise 4.98 percent[1]. A year earlier, the index rose 2.56 percent in the same period. The available data show that, on average, the S&P 500 index rose 1.3 percent during the duration of this phenomenon. Overall, this rally has produced positive results for investors 34 times in the past 45 seasons, and according to the Stock Trader's Almanac, the percentage of times the rally has occurred has grown to 67 percent since 1993. [*]

The exception proves the rule

As can be seen from the above data, however, the Santa Claus rally effect does not occur every year, so the development cannot be 100% predicted. What is undoubtedly interesting, however, is the fact that during bear market trends and economic downturns, this phenomenon can be even stronger. During the recession, which lasted from October 2007 to March 2009, we saw two rallies - one in the week of December 17, 2008, during which a 1.32 percent increase was recorded. The second from December 29, 2008, when the increase was as high as 6.81 percent. [*] During the last three recessions, there have been a total of five holiday seasons, with Santa Claus rallies recorded in four of them.

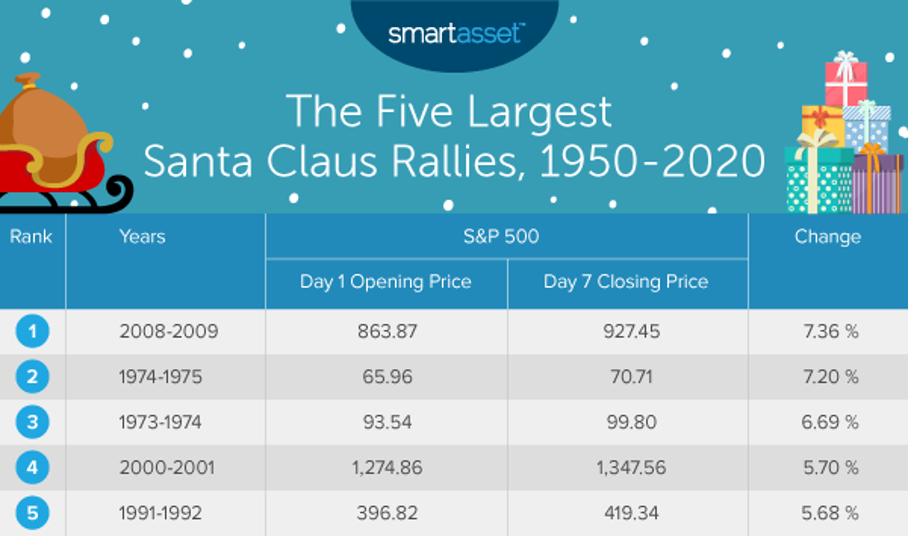

Chart: performance of the S&P 500 Index during the five biggest Santa Claus Rallies until 2020 (Source: Smartasset.com) [*]

Reasons for the formation

There are several hypotheses that justify the origin of the Santa Claus Rally. One is tax optimization and the associated closing of losing positions at the end of the year and subsequent reinvestment of funds. Another may be a general feeling of optimism among investors due to the festive mood, which is also influencing events on Wall Street. Large investors often spend these holidays away from the trading world, while the market is dominated mainly by retail investors who tend to be bullish. Another factor that can influence the formation of a rally is Christmas bonuses, which were not used to buy presents and can serve to boost investment portfolios. Last but not least, in recent years, the fact that a number of investors have been expecting a rally to occur and have therefore bought shares, thus contributing to the fulfilment of this expectation, has undoubtedly also contributed to the rally's emergence.

While the Santa Claus Rally can undoubtedly be a pleasant way for investors to end the old year and start the new one, the key to the success of any investment remains regularity and appropriate portfolio diversification in order to minimize risks.

Olívia Lacenová, analyst of Wonderiterest Trading Ltd.

[*] Past performance is no guarantee of future results

[1] https://www.investing.com/indices/us-spx-500