Russian President Vladimir Putin said last week in a video conference on local state television that he would not accept non-domestic currencies for commodity supplies. He also ordered the state-owned gas company Gazprom to adjust its contracts in this way. The local central bank and the government have been given a one-week transition period to determine how to switch from payments in foreign currencies to payments in rubles. The changes are expected to affect only the currency used to settle payments and countries Russia considers hostile and which impose severe sanctions on it. In total, 48 countries are involved.

Although supply disruptions are not yet the topic of the day, this step remains one of the options in the tightening of sanctions against Russia. If this were to happen, industry would be the most affected, where production could be curtailed, and households would also be affected later. Central European countries, including Slovakia, would be particularly affected by the 'shortage', not to mention the fact that prices would go up significantly. This would also affect electricity prices. The prices of both commodities have been rising for some time as a result of the energy crisis. [1]

Russia accounts for around 40 percent of Europe's gas supply. According to the European Commission's European Gas Market Report, total gas consumption in Europe for the full year 2020 reached 394 billion cubic meters of gas. The United States has agreed to increase its gas supplies to Europe and, according to a White House statement, has committed to supply 50 billion cubic metres of gas from next year, roughly the same as the Nord Stream 1 pipeline from Russia to Germany today.

The European Commission's statement shows that it plans to reduce the EU's dependence on Russian gas by two-thirds and to end its dependence on Russian supplies of the commodity much earlier than 2030. This is to be achieved by a faster transition to clean energy and alternative sources, with individual countries being responsible for implementing these steps.

However, the information available so far suggests that, as things stand, Europe would face an energy deficit even if the US, Norway and Azerbaijan were to send as much of the commodity as possible.

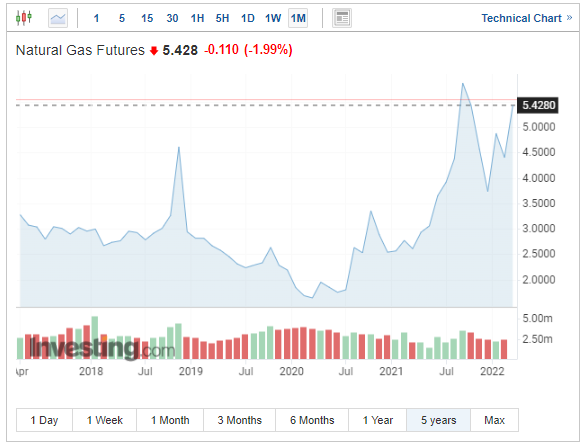

The price of the gas futures contract has risen 45% since the beginning of 2022 to more than $5.4 per MMBtu. That's a year-over-year increase of as much as 106%. The commodity's five-year performance has seen a slightly lower appreciation at 72%. *

Graph: Development of the value of the natural gas futures contract over a five-year horizon. (Source: Investing.com)

Of course, the rise in the price of the commodity itself is positively reflected in the rise in the value of shares of companies such as natural gas or oil producers. If concerns about gas shortages persist or the situation escalates, prices can be expected to rise further. Conversely, if the situation manages to stabilise, a slight correction from current levels is likely [2].

* Past performance is no guarantee of future results

[1,2] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. These statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.