In general, 2022, a year marked by the war in Ukraine, rising inflation and slowing global economic growth, has not been kind to technology stocks. Shares in Apple, Amazon, and Microsoft have fallen 20 percent from their peaks, while the S&P500 index of which they are a part has written "only" 17 percent off its "high".* It turns out that this decline has benefited Apple in particular, which has managed to stay ahead of its competitors. At the beginning of March 2022, it even surpassed a valuation of USD 3 trillion.

The highest valuation

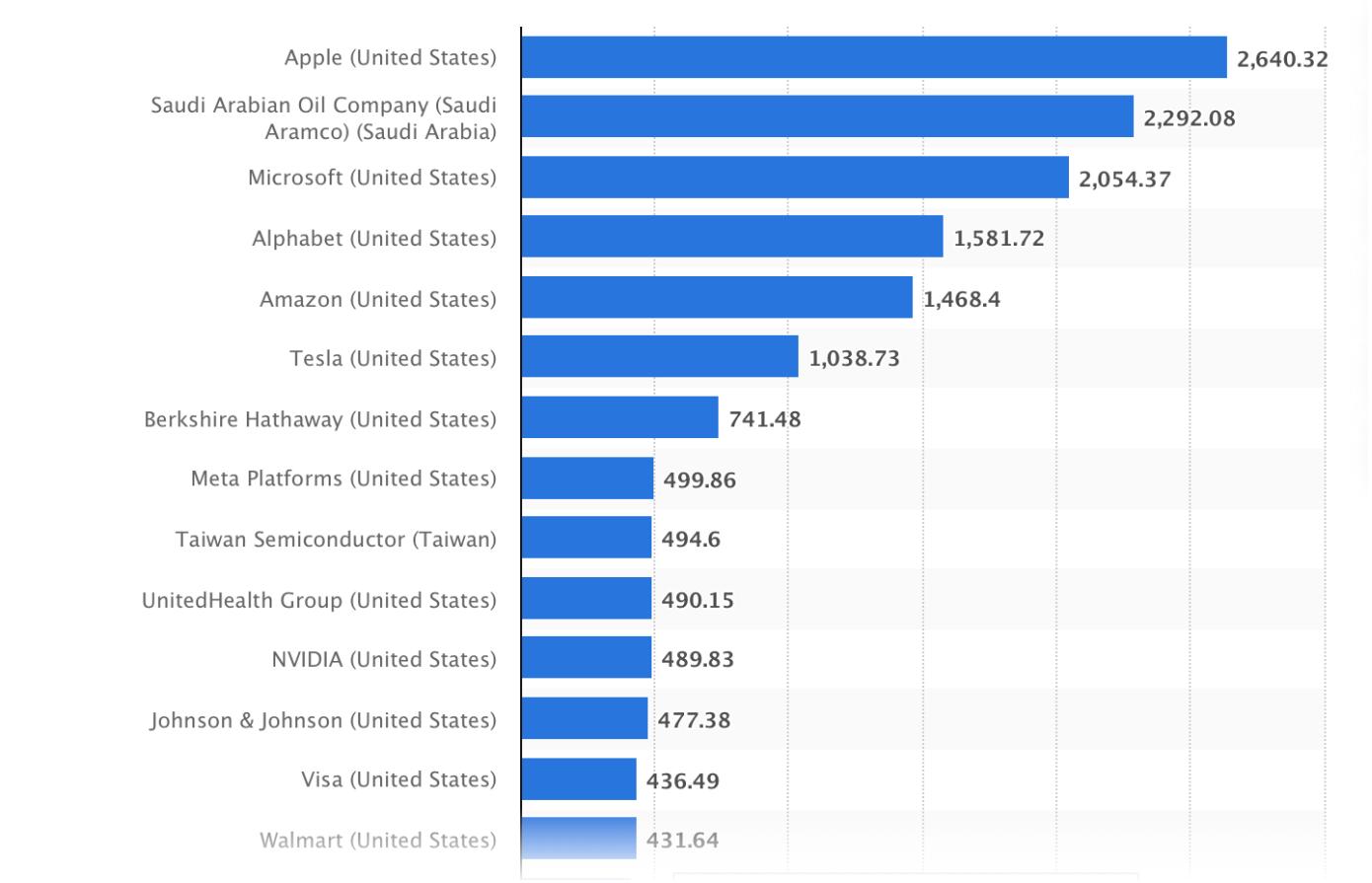

At the time of writing this analysis, Apple had a market capitalization of more than $2.35 trillion, which means that it remains at the top of the list of the most valuable companies on the stock Exchange.[1] For comparison, in second place is the oil giant Saudi Aramco with a valuation of USD 1.89 trillion[2], Microsoft in third place with USD 1.90 trillion[3] and Amazon in fourth place with a valuation of USD 960 billion.[4]

List of the most valuable companies by market capitalisation

as of April 2022, in USD billions.

(Statista.com)

Why is it the most valuable?

Apple maintains its top spot mainly due to its rapid growth. In the fourth quarter of 2022, the company's revenue reached $90.1 billion, representing a year-over-year increase of 8 percent. Net income rose to $20.721 billion, only slightly higher than the same period a year ago. With the Christmas period approaching, which tends to be the best time of the year for companies, this represents a good outlook for the period ahead. [1]

Historically the first company to break the trillion-dollar mark

Interestingly, it was Apple that became the first publicly traded company in the US. It crossed this milestone on August 2, 2018, when it reached a market capitalization of $1 trillion. It later lost the top spot, but this year it maintains a solid lead over its competitors.

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.

[1] https://www.google.com/finance/quote/AAPL:NASDAQ?sa=X&ved=2ahUKEwij6Lbh3uL7AhUIQvEDHV9qDH0Q3ecFegQIHRAj

[2] https://www.google.com/finance/quote/2222:TADAWUL?sa=X&ved=2ahUKEwiXvraC3-L7AhUqR_EDHflSATsQ3ecFegQIKBAh

[3] https://www.google.com/finance/quote/MSFT:NASDAQ?sa=X&ved=2ahUKEwiw8vea3-L7AhWqcvEDHfKmBggQ3ecFegQIJRAj

[4] https://www.google.com/finance/quote/AMZN:NASDAQ?sa=X&ved=2ahUKEwisudGu3-L7AhUNSvEDHSzVAV4Q3ecFegQIJRAh