Over the course of the year, stock markets have been pressured by events associated with the war in Ukraine, uncertainty associated with Western sanctions against the Russian superpower, rapid inflation and associated price rises across the board, led by the energy crisis and high oil, gas and electricity prices. Add to this the rise in central bank interest rates and fears of a recession, and it is no wonder that the US S&P 500 stock index at the end of September was 25 percent below its highs at the start of the year.*

There is no certainty

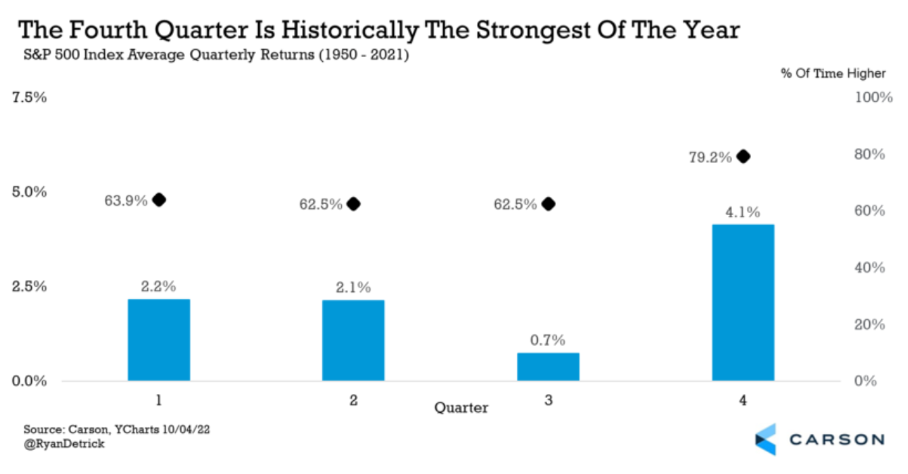

It is important to recognize that no two years are the same, and historical data does not necessarily mean that past performance is repeating itself. And that applies to both losses and gains. This is because the conditions in the economy and on the markets are constantly changing and are always specific to a given period. On the other hand, we can see from historical performance that the fourth quarter of the year tends to be the strongest for U.S. stocks.

Chart: Development of the average quarterly returns of the S&P 500 index (1950-2021).

Positive factors

Looking at the Carson Group data, we can see that the S&P 500 index grows by an average of 4.1 percent during the last quarter of the year, nearly 80% of the time. In addition, historically, this period tends to be even better if the markets have declined significantly during September. With this year's September becoming one of the worst ever for equities, this could be a good sign for growth for the next period after turbulent market corrections. [2] Moreover, October is known for ending bear trends most of the time. This year was the worst start to a year since 1974 and 2002, and in both cases the bear trend ended in October. So, the question is: Are we due for a change in trend to bullish? With the year-end buying spree looming, we can expect that it most likely will. [3]

* Past performance is no guarantee of future results.

[1,2,3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.