The value of the price of gold in recent weeks has reflected developments in the currency markets. The dollar index has been falling since mid-July, while the price of gold has been strengthening. As the current dollar value has turned towards the bull market, the price of gold is experiencing the opposite trend.

Interest rates have sent the metals down

The rise in the value of the dollar was supported by comments from Fed officials that the bank will stick to a sharp pace of rate hikes this year to curb rising inflation. The President of the Fed in St. Louis, James Bullard, said on Thursday that he currently supports a third rate hike of 75 basis points in September. San Francisco Fed President, Mary Daly, also hinted at a potential hike of 50 to 75 basis points during the Fed's next meeting to keep rates above 3 percent until the end of 2022. According to the minutes of the July meeting, a substantial rate hike is preferred by a majority of members as an effective tool to fight inflation.

Dollar back in uptrend

The rise in interest rates has caused the dollar to largely overtake gold as the preferred "safe haven" in turbulent times in the capital markets. It took gold the proverbial "wind out of sails" after the outbreak of war in Ukraine, when it once again broke the $2,000 per ounce mark.*

Interest in gold persists

Although the gold price has seen a correction in recent days, overall it has enjoyed strong investor interest throughout the year. Gold stocks on the COMEX exchange have been slowly declining for several months. In the last 7 months, over 7 million ounces have been taken out of storage. According to published information, stockpiles have fallen below 30 million ounces for the first time in 2 years. Therefore, investors' interest in this kind of "diversification" of their investment portfolio continues. Interesting information is that silver held in the LBMA vaults in London is also gradually disappearing. Investors therefore continue to show a strong interest not only in various types of investment instruments that replicate the price of the precious metal, but also in its physical purchase.

Correction as an opportunity?

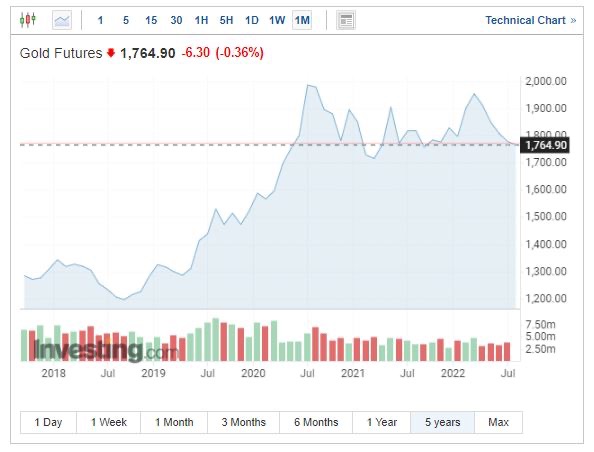

At the moment, it seems that the current correction around the level of USD 1,763 per ounce could represent a good opportunity for investors who would like to expand their portfolio with this commodity, whether in the form of futures, ETFs or, for example, physical purchases themselves, to buy it at a good price. After all, in the long run, gold is in my opinion still the "best" security for more conservative investors. In fact, looking at its performance over the last 5 years, we can see a 38 percent increase in value.*

Development of the value of gold over the last 5 years. (Source: Investing.com)

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.