It seems that the crazy bull trend that caused the NFT market to grow 705% in three years to $338 million (by the end of 2020), as well as the euphoric period of 2021, is long over * Unlike the stock market, which has seen a recovery, the NFT market continues to cool down. According to a report published on Nonfungible.com, the massive negative sentiment from the global economy in the second quarter of 2022 finally penetrated this non-traditional investment segment, allowing artists to monetize their digital artworks.

Sales plummet

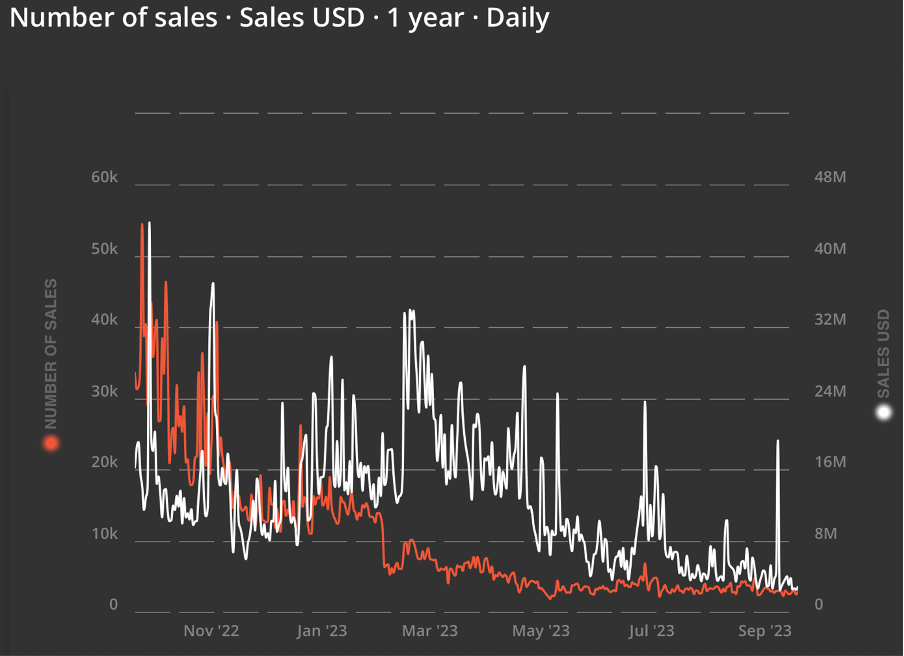

Over the last year, we can observe that NFT sales have had a significant downward curve. While on September 20, 2022, daily NFT sales were 33,600 units and totaled approximately $16 million, looking at the chart from September 19, 2023, we can see a significant weakening and daily sales below 2,900 units with a total volume of $2.8 million.

Chart: evolution of the value of daily NFT sales in number of units and daily sales in USD.

(Source: Nonfungible.com)

Market saturation and counterfeits

Another reason why the cooling of investor interest is still persisting is the market oversaturation, which has resulted in a gradual decline in the value of works that used to be auctioned for millions. The constant influx of new projects and artists has eventually led to a glut in the market and a subsequent drop in demand. Not to mention that there were also scammers who tried to sell fakes, which increased investors' distrust and caution.

The future is uncertain

Although some experts have argued from the beginning that this is a purely speculative investment, this does not mean that the NFT market is dying. The buying frenzy that we saw in the early years of the phenomenon is, at least for now, definitely over, but NFTs have undoubtedly secured their stable place in the digital blockchain world and there is no sign that they will not once again win the hearts of investors en masse. Given the implementation of this technology into everyday virtual and gradually real life, it is quite possible that we could see a renewed interest in investing in this market in the future[1].

Olivia Lacen, principal analyst at Wonderinterest Trading Ltd.

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future results. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.