Bitcoin está en el punto de mira

En los debates sobre la economía verde, la criptodivisa de la que más se habla es Bitcoin, que según Coinmarketcap.com sigue dominando más del 40% del mercado y su valor actual supera ligeramente los 37.000 dólares. Bitcoin en particular ha sido retratado negativamente por muchos en los últimos años, ya que se sabe que libera 40 millones de toneladas de dióxido de carbono a la atmósfera anualmente cuando se mina. La cantidad de energía consumida sólo en las transacciones de Bitcoin también es significativa. Una transacción media "quema" más de 1.700 kWh de electricidad, casi el doble del consumo mensual de un hogar estadounidense medio. Para que se haga una idea aún mejor, según Digiconomist, un Bitcoin tiene la misma huella de carbono que 1.879.709 transacciones con Visa.

El foco se ha desplazado de China a Estados Unidos

Tal vez en parte debido a la intensidad energética antes mencionada, un número significativamente creciente de mineros estadounidenses están desarrollando nuevas estrategias de negocio con el potencial de reducir el impacto medioambiental negativo de la criptodivisa más famosa. El Congreso de Estados Unidos debatió recientemente cómo contribuir a una minería de criptodivisas más ecológica. La cuestión más acuciante era si utilizar únicamente recursos renovables para minar Bitcoin o centrarse en otras blockchains que no requirieran tanta energía. La medida es el resultado lógico de que EE.UU. se haya convertido en el nuevo epicentro mundial de la minería de criptodivisas después de que China prohibiera el año pasado la minería de criptodivisas, a pesar de que ostentaba el liderazgo mundial en este sector.

Las cifras hablan por sí solas

Las conclusiones de un nuevo trabajo de investigación sobre el mix energético y la huella de carbono de la red bitcoin, Revisiting Bitcoin's carbon footprint, publicado en Elsevier Joule el 25 de febrero de 2022, muestran que la supresión de la minería en China durante el último año no sólo ha sacudido la actividad minera global asociada a bitcoin, sino que también ha reducido significativamente el uso de recursos renovables que alimentan la red durante la minería del 41.6% al 25,1%. La razón es muy sencilla. Durante la temporada de lluvias en los meses de verano, los mineros de criptodivisas tenían acceso a energía hidroeléctrica en China, que perdieron cuando se prohibió la minería en ese país y tuvieron que trasladarse a EE.UU. o Kazajstán. Dado que estos países suministran a los mineros más electricidad procedente del carbón y el gas, la huella de carbono de la minería de Bitcoin ha aumentado, estimándose en el estudio un incremento del 17%. Estos datos sugieren, por tanto, que Bitcoin se ha vuelto recientemente mucho menos "verde" que nunca.

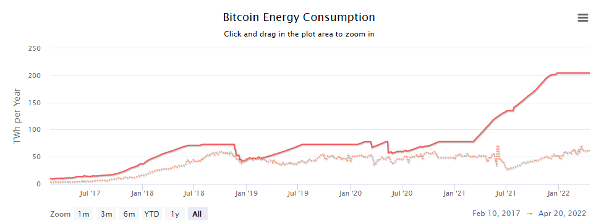

El índice de consumo está aumentando

El Índice de Consumo de Bitcoin siempre proporciona la estimación más actualizada del consumo total de la red Bitcoin. El 20 de abril de este año se situaba en 204,50 teravatios hora (TWh). En la misma fecha del año anterior, era de sólo 103,78 TWh. Si miramos cinco años atrás, el consumo era de sólo 10,2 TWh. En este contexto, sin embargo, es importante señalar que el consumo de energía también aumenta gracias al creciente número de mineros. La buena noticia para los entusiastas del clima es que el número total de bitcoins está limitado a 21 millones, con más de 19 millones ya minados a principios de abril.

Gráfico: Evolución del índice de consumo energético de Bitcoin de 2017 a 2022

Cambio verde

Por otro lado, cabe destacar que cada vez hay más empresas que intentan utilizar la energía generada por la minería de Bitcoin de forma eficiente. La minera canadiense MintGreen anunció hace algún tiempo que puede recuperar hasta el 96% de la energía de la minería y, gracias a ello, planea ayudar a calentar 100 hogares en North Vancouver en asociación con Lonsdale Energy Corporation (LEC). De hecho, LEC buscaba oportunidades en el sector de las energías renovables en lugar del gas natural convencional. Además, MintGreen firmó un acuerdo de suministro con el productor de whisky Shelter Point Distillery. Como resultado, la energía generada no acabará en la atmósfera en forma de gases de efecto invernadero.

La competencia no se queda atrás

Por supuesto, cabe señalar que hay criptodivisas que consumen mucha menos energía que Bitcoin. Entre ellas se encuentran, por ejemplo, Cardano o Ethereum. Esta última funcionaba originalmente, como Bitcoin ahora, con un modelo de prueba de trabajo que consume cantidades significativas de electricidad. Aunque hasta hace poco Bitcoin se consideraba muy intensivo en el consumo de energía debido al alto consumo de energía durante la minería, ahora se está haciendo evidente que esta energía se puede utilizar de manera eficiente. Esto podría ayudar a reducir gradualmente su impacto medioambiental. Aunque su huella de carbono se ha visto temporalmente afectada de forma significativa por la prohibición de la minería de criptomonedas en China y el traslado de los mineros a zonas de mayor consumo energético, no hay por qué tirar la toalla. En mi opinión, la criptodivisa más antigua tiene su lugar como parte de la revolución energética que estamos presenciando en directo. La minería y las transacciones de criptodivisas siguen planteando retos energéticos y de emisiones, pero si los mineros están dispuestos a adaptarse a las nuevas "tendencias verdes", el futuro puede depararnos algunas sorpresas agradables. Por tanto, en mi opinión, Bitcoin se mantiene en una posición fuerte.

Por Olívia Lacenová, Analista Jefe de Wonderinterest Ltd