El pasado otoño, Facebook anunció que había decidido tomar una nueva dirección y centrarse en el mundo virtual (Metaverso), al que también adaptó su nuevo nombre, Meta Platforms. El metaverso se utiliza cada vez más en nuestro mundo.

Hay muchos ejemplos del uso de mundos virtuales 3D en el mercado global. En febrero, Decentraland organizó la primera boda que tuvo lugar en un entorno metaverso basado en blockchain, según informó Cointelegraph. Con ello, Decentraland se dio a conocer a través del comercio de terrenos en mundos virtuales. El popular juego Roblox y varios otros proyectos también se basan en la realidad virtual. Por eso Meta Platforms ve su futuro en este floreciente mundo de la realidad virtual, que describe como la evolución de la conexión social en la sociedad. Y es que los lugares 3D del Metaverso no sólo nos permiten socializar sin necesidad de desplazarnos físicamente, sino también aprender, colaborar y jugar de formas que superan las posibilidades de nuestra imaginación.

Gafas inteligentes

En este contexto, la compañía informa en su página web que está desarrollando tecnologías wearables como las gafas inteligentes, que pretenden ser una de las puertas de entrada al entorno Metaverso y permitirnos interactuar con el mundo que nos rodea. En este sentido, Meta Platforms ha unido fuerzas con EssilorLuxottica para crear las primeras gafas inteligentes llamadas Ray Ban Stories. Se presentaron a finales del año pasado y permiten grabar audio y vídeo con un solo toque. Se espera que se vendan por 329 euros y estarán disponibles en línea y en tiendas minoristas seleccionadas de España, Austria y Bélgica en 20 diseños. Al mismo tiempo, deberían ser sólo el primer paso en este viaje hacia la implantación de entornos virtuales en la vida cotidiana.

El año 2022 no ha empezado de la manera más feliz

Este año no parece ser uno de los más idóneos para la compañía. Primero, las acciones se desplomaron al conocerse que el número de usuarios de la plataforma había caído por primera vez en sus 18 años de historia. Más tarde, la empresa informó de que podría tener que cerrar sus servicios clave de redes sociales Facebook e Instagram en Europa debido al GDPR. Otro de los informes negativos fue la información de que cancelaba su proyecto de criptomoneda Diem, que se suponía que iba a ser una alternativa a las monedas fiduciarias tradicionales para un número estimado de hasta 2.000 millones de personas. Y con eso, la serie de malas noticias ciertamente no terminó. La empresa también informó de un fuerte aumento del coste de desarrollo de la tecnología virtual del futuro y de una previsión de escasas perspectivas de ingresos derivados de la misma. Meta también reconoció una ralentización del crecimiento de los ingresos en general. Citó como motivo el aumento de la competencia.

Zuckerberg cayó en el ranking de los ricos

Las informaciones mencionadas desencadenaron un sentimiento negativo entre los inversores, que se transformó en una importante caída del valor bursátil de la compañía en febrero como consecuencia de las preocupaciones. El fundador de la empresa, Mark Zuckerberg, también perdió decenas de miles de millones de euros, saliendo de la lista de las diez personas más ricas del mundo por primera vez en siete años.

La caída de los resultados

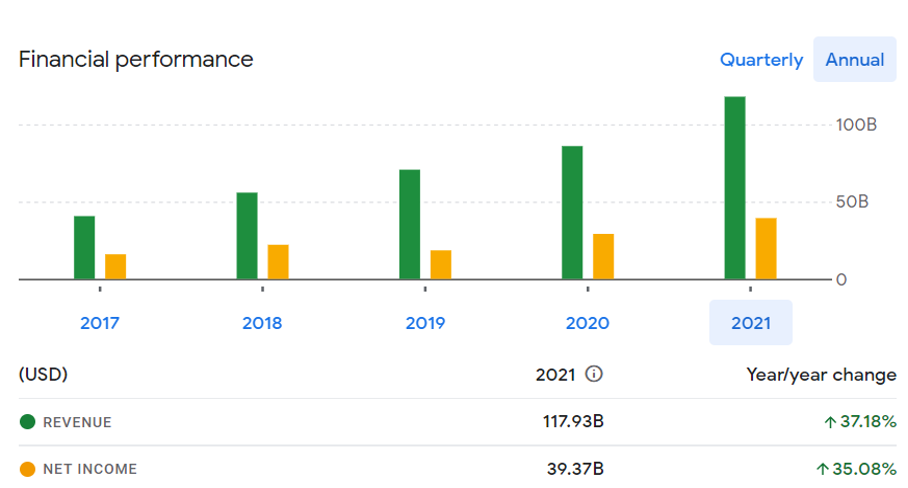

En su último informe financiero correspondiente al primer trimestre de 2022, la compañía registró unos ingresos de 27.910 millones de dólares, lo que supone un crecimiento interanual del 6,64%. El beneficio neto fue de 7.470 millones de dólares, pero eso supuso un descenso interanual del 21,40 por ciento. Sin embargo, si observamos los informes anuales de los últimos cinco años, podemos ver que los ingresos y el beneficio neto han ido aumentando cada año.

El rendimiento de Meta Platforms Inc en los últimos 5 años. (Fuente: Google Finance)

La evolución del valor de la acción

En el momento de redactar este informe, la acción estaba valorada en 195 dólares.13, un aumento de más del 410 por ciento desde que la acción salió a bolsa en 2012. Por otro lado, debido a los factores mencionados anteriormente, ha caído más de un 42 por ciento durante este año. Alcanzó su máximo en septiembre de 2021, cuando su precio alcanzó los 378 dólares por acción. También se puede apreciar una revalorización interesante al observar la evolución en un periodo de cinco años, donde vemos que la acción ha logrado un crecimiento del 27 por ciento.

Si la compañía logra resolver sus problemas actuales, podría seguir representando una interesante diversificación de la cartera de inversión para los inversores a largo plazo.

La evolución del valor en bolsa de Meta Platforms Inc en los últimos 5 años.

(Fuente: Google Finance)

* Las rentabilidades pasadas no garantizan resultados futuros.

[1] Las declaraciones prospectivas se basan en suposiciones y expectativas actuales, que pueden ser inexactas, o en el entorno económico actual, que puede cambiar. Estas afirmaciones no garantizan resultados futuros. Implican riesgos y otras incertidumbres difíciles de predecir. Los resultados pueden diferir materialmente de los expresados o implícitos en cualquiera de las declaraciones prospectivas.

La información contenida en estas declaraciones no garantiza resultados futuros.