Walmart se centra en la salud en los próximos años. El mayor minorista del mundo ampliará su plan de asistencia sanitaria más avanzada. Introducirá una membresía de salud que proporcionará a los clientes servicios médicos a distancia ilimitados 24 horas al día, 7 días a la semana, servicios de nutrición, un servicio de ambulancia de emergencia, descuentos en consultas con especialistas y descuentos en revisiones médicas, previo pago. En el proyecto participarán 1.500 farmacias y 500 clínicas médicas de toda la región. Además, Walmex ha recibido el permiso de las autoridades mexicanas para adquirir uno de los proveedores de pago electrónico.

El plan también se expandirá en EE.UU.

Por otro lado, la compañía ha anunciado que abrirá 28 nuevos centros médicos en EE.UU. el próximo año, incluyendo los primeros en Missouri y Arizona. Para finales de 2024, prevé contar con más de 75 centros Walmart Health en todo el país. A finales de 2022, operaba 32 de ellos.

Las fuentes de ingresos de la compañía cambiarán en los próximos años

Según el director financiero de la compañía, John David Rainey, los beneficios de Walmart procederán gradualmente sobre todo de sus ventas online, servicios de entrega y de la publicidad en Walmart.com, y no de las ventas de productos en las 10.000 tiendas, que actualmente suponen la mayor parte del beneficio total. Rainey espera que esa contribución cambie en los próximos cinco años. El gasto se está desplazando de los bienes a los servicios, como la sanidad, el alquiler y el ocio, ya mencionados.

El objetivo es la digitalización

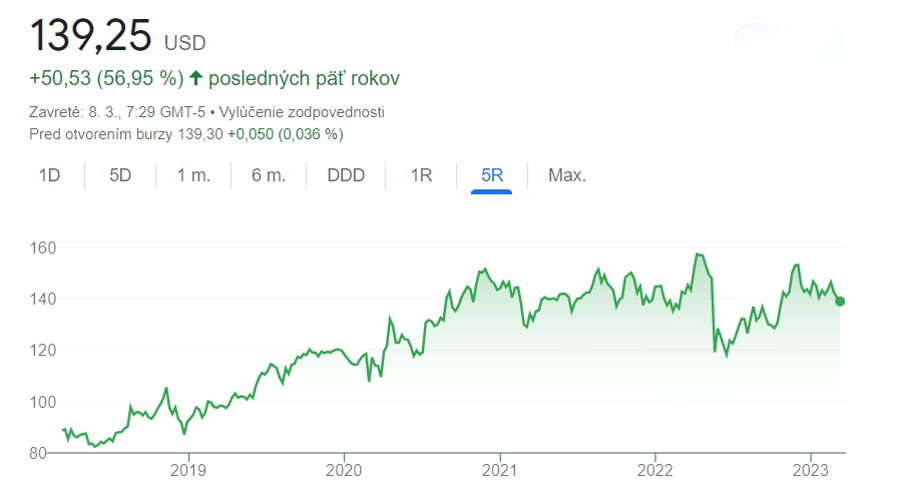

A medida que los clientes confían cada vez más en el comercio electrónico, éste permite a Walmart ofrecerles mayor comodidad y más puntos de distribución. El negocio de medios minoristas de la empresa, rebautizado como Walmart Connect en 2021, ofrece a las marcas espacios publicitarios en sus tiendas de Estados Unidos y permite utilizar los datos de los compradores para racionalizar la publicidad, incluso en sitios web y aplicaciones que Walmart no posee. Las diversas extensiones de la empresa son una muestra de innovación, y su alcance se extiende a muchas áreas. Esta diversificación confiere cierta estabilidad a las acciones de la empresa y la convierte en un elemento decididamente interesante para las carteras de los inversores. Como también podemos ver al observar el rendimiento a cinco años del valor bursátil de la empresa, ha crecido un 56%, rondando los 139 dólares por acción durante la semana pasada.

* Rentabilidades pasadas no garantizan resultados futuros

Rentabilidad de la acción de Walmart en los últimos 5 años. (Fuente: Google)

Olivia Lacenova, analista de Wonderinterest Trading Ltd., ha analizado la evolución de la acción de Walmart en los últimos 5 años.