The sell-off kicked off after the US central bank, the Fed, announced a significant increase in interest rates by 0.75 basis points to a level of 1.50 to 1.75 percent. Cryptocurrencies have been under pressure for some time as a result of monetary tightening linked to rising inflation. Investors have been moving away from riskier assets, culminating just after the announcement of the most significant rate hike in 30 years, not to mention that the Fed has also indicated that a similar scenario could be repeated in July.

Bitcoin below $ 20,000

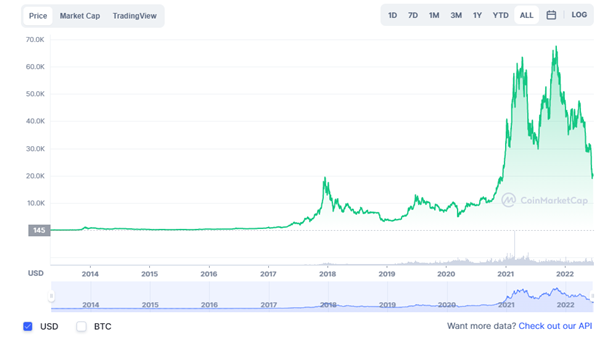

Bitcoin enthusiasts will certainly not remember these days with joy. Not long ago, experts were racing to guess when the king of cryptocurrencies would surpass the 100 thousand USD mark, and now the question has turned: "How far can it fall?" However, it is important to realize that the decline has not only affected cryptocurrencies, but also other assets such as stocks, indices, etc. Asset prices are also being pushed down by the deterioration in living standards due to rising prices and the rise in energy prices due to the energy crisis, not to mention that the war in Ukraine is not helping the situation either. While at the same time a year ago bitcoin was at around 31 thousand USD and heading for a new all-time high, today its price is hovering around the 20 thousand USD mark.*

Development of bitcoin price over the years. (Source: Coinmarketcap.com)

Growth potential

For cryptocurrencies, the potential for growth and their increasing acceptance in mainstream payments is a key determinant of demand. On the other hand, it is considerably more difficult to estimate the development of their value based on economic factors than in the case of traditional assets. At the same time, it is important to note that they are still highly volatile. However, just as they have to face significant falls in value, we have seen many times that they can also show an outstanding growth rally in a relatively short period of time. [1]

Olívia Lacenová, Chief Analyst of Wonderinterest Trading Ltd.

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.