In practice, green transformation and electrification are not happening fast enough. However, this may represent a potentially interesting opportunity for investors in the renewable and non-renewable energy sector, which will be necessary to overcome the aforementioned crisis and its associated 'pitfalls'.

Dependence on fossil fuels

Although the topic of the transition to green energy was already being addressed before the onset of the pandemic, including the electrification of various parts of the economy to reduce carbon emissions that are part of the current way of life, the Statistical Review of World Energy for 2022 by the British company BP shows that global fossil fuel use is currently at 82 percent, while five years ago it was at 85 percent. In practice, this means that the economy is still dependent on fossil fuels, and while their share will gradually decline, it will probably take a long time before renewables can take over. “Green energy” is not growing as fast as it should. In this context, diversifying the portfolio into shares of coal mining companies, which still hold the lead as a fuel for the production of electricity, may be interesting.

The price of electricity is rocketing

Did you know that the price of electricity in Europe reached nine times its 2007 level in mid-August? And it's still rising. This has been helped by the end of dependence on energy supplies from Russia, which greatly limits the possibilities of the volume of available energy from other sources, not to mention the need to build the related infrastructure.

Growth across Europe

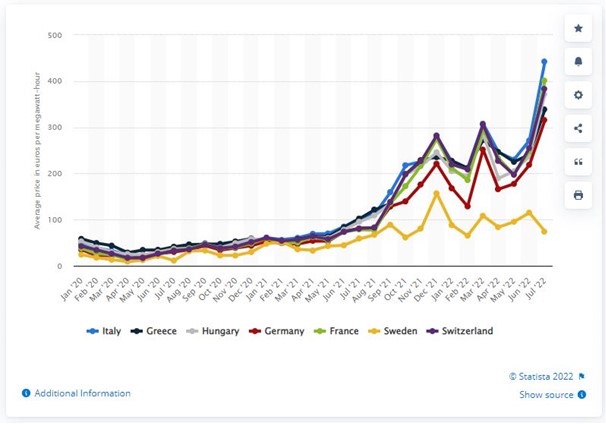

Looking at the graph of Statista.com, which shows the evolution of prices in selected European countries since 2020, we can see that in Italy, for example, the price of electricity was 38 euros per megawatt hour in July 2020, while in July 2022 it was already 441.74 euros per megawatt hour, which represents an increase of 1062 percent in 2 years. A similarly high increase can also be observed in other selected countries such as Greece, Hungary, Germany, or France. Thus, the inclusion of shares of various electricity-related energy companies may have great potential in the composition of an investment portfolio.

Graph: Development of average monthly wholesale electricity prices in selected countries of the European Union from January 2020 to July 2022 (Source: Statista.com)

Gas and oil are interesting

Going green and getting off fossil fuels without stopping the growth of countries' wealth is probably the greatest challenge the global economy has ever faced, because growth in wealth is growth in a country's GDP, and that has been closely linked to CO2 emissions for decades. On the other hand, it brings with it the potential opportunity to invest in the energy sector, not only in terms of electricity or coal, but also in the oil and gas sector and related industries, where we can also see high price increases. But we will talk more about that in future posts.

Olivia Lacenova, analyst at Wonderinterest Trading Ltd.