No New EV Models in 2022

One of the major elements behind the recent decline of the Tesla stock has been the company’s announcement towards the end of January, that it shall not release any new electric vehicle models this year. This includes the highly anticipated and quite popular Cybertruck. This is because of the global chip shortage, which has disallowed the company to build 50% more vehicles than last year as it has originally planned.

Hence, Tesla aims to direct its efforts towards increasing the production of existing models in current and new factories. The company plans to bolster production in the United States and Germany; an initiative which can revitalize the health of the company and its future outlook. [1]

Escalating Competition

Another factor which weighed down on the booming business is the increasing rivalry & competition in the electric vehicle spectrum. The global market share of electric cars has more than doubled in 2021, as nations around the world have adopted electric vehicles as the ultimate driving machine of the present & future. Tesla continues to dominate the market share, followed by USA-based Rivian and Lucid Motors. But, demand in China has been surging, with the likes of Nio, XPeng and Li Auto dominating the EV market of the Asian nation, which provide smart, connected, fast and relatively cheaper models when compared to Tesla’s.

Other Factors to Consider

Tesla has witnessed some quality control issues and autopilot complications in early 2022, but such factors aren’t too major compared to the rising geopolitical tensions in Eastern Europe, which has swayed investors away from dollar-backed assets such as stocks, and towards safe havens such as gold. The Russia-Ukraine conflict had major repercussions on the global markets, with fear, uncertainty and volatility apparent in capital and equity markets.

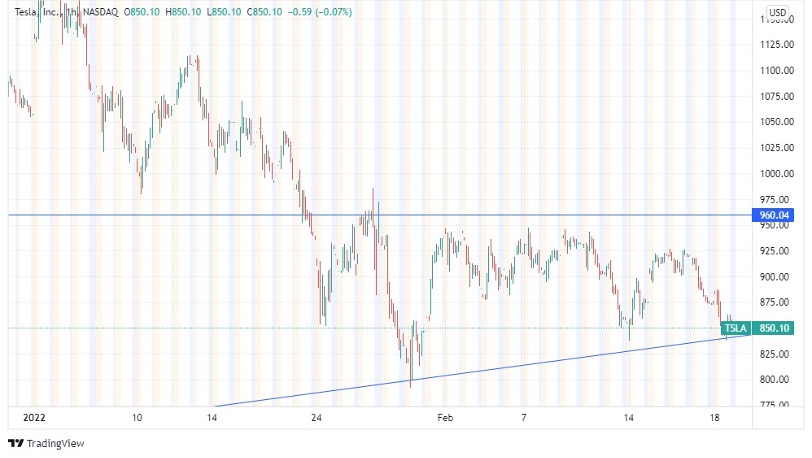

Technical View*

Looking through a technical lens, the Tesla stock is exhibiting a negative short-term trend, on a neural long-term trajectory. The Tesla stock, currently priced at $856 apiece, is trading between a support level ranging from $824 to $850, and several resistance levels. One lies at $960, and a higher one for the long-term is at $1,230, when looking at the daily time frame.

The Bright Side

Despite that, the company’s latest earnings, reported in late January, have been quite impressive. Its adjust earnings were $2.52 per share, against the $2.36 expected by analysts. The company also enjoyed $17.72 billion in revenue, which is $1.15 billion more than analyst expectations, according to Refinitiv, escalating 65% year-over-year this quarter.*

Also, the tech tycoon plans to drive down costs through product localization, new battery technology, economies of scale and higher efficiency, which has been evident in the automaker’s latest quarter results. With the stock price currently near a significant support level, this marks as an attractive entry point for investors to buy the dwindled stock of one of the world’s leading electric car manufacturers.

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.