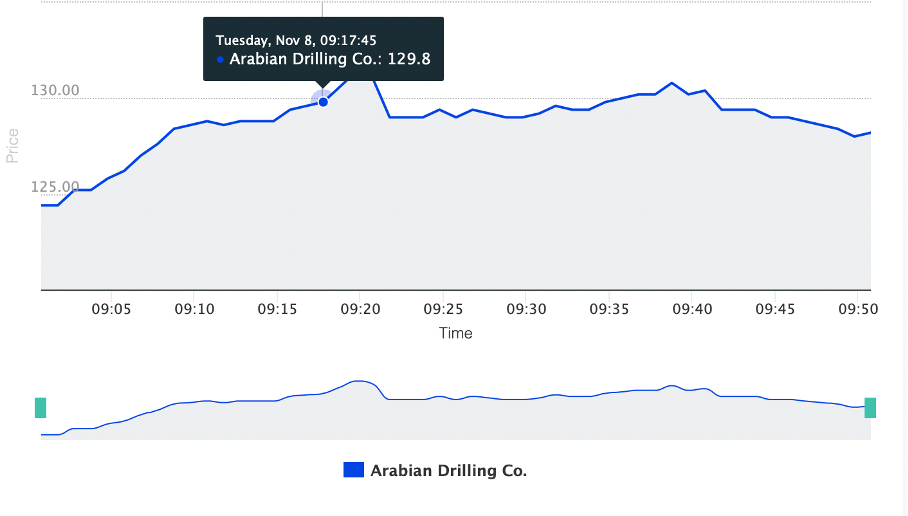

Gráfico: Evolución del valor de Arabian Drilling desde su salida a bolsa en Tadawul.

(Fuente: saudiexchange.sa)*

Es interesante observar que esta OPV es la última de una serie de las celebradas este año en el Golfo Pérsico. El valor de las acciones en la apertura bursátil fue de 118 riales (31,40 dólares) y supuso para la empresa un total de 2.670 millones de riales. La empresa había declarado antes de la cotización que el 90% de los 26,7 millones de acciones ofertadas se asignarían a inversores institucionales y el 10% quedaría para clientes minoristas.

Líder en el campo de la extracción de petróleo y gas

Fundada en 1964, Arabian Drilling opera una flota de 45 plataformas de perforación, tanto en tierra como en alta mar, que incluyen equipos capaces de perforar hasta profundidades de 375 metros bajo el nivel del mar. También dispone de buques de servicio autopropulsados polivalentes que pueden intervenir y probar pozos sobre el terreno. Es líder en este campo en Arabia Saudí y tiene previsto expandirse a otros países árabes del Golfo Pérsico, concretamente Kuwait, Bahrein, Qatar, Omán y los Emiratos Árabes Unidos.

Lucrativa clientela

Arabian Drilling es propiedad de Industrialization & Energy Services Company, que posee el 51%, y Services Petroliers Schlumberger S.A, que posee el 49% restante. La empresa cuenta con más de 4.400 empleados y entre sus principales clientes figuran Saudi Aramco, Schlumberger Middle East S.A., Al-Khafji Joint Operations, Dowell Schlumberger Saudi Arabia Ltd. y Baker Hughes Saudi Arabia.

Esperanzas de una gran demanda

En su página web, la empresa informó de que actualmente espera una gran demanda de sus servicios debido al aumento de los precios de las materias primas y a las preocupaciones por la seguridad energética como consecuencia del actual entorno macropolítico y económico. [1] Por este motivo, puede seguir siendo un atractivo interesante para los inversores.

Compromiso medioambiental

La empresa considera la protección del medio ambiente y la reducción del impacto de su actividad en el entorno como una de sus principales prioridades. Como parte del objetivo de Arabia Saudí de lograr cero emisiones para 2060, la empresa se ha comprometido a reducir el consumo de energía y las emisiones de dióxido de carbono, y ha puesto en marcha iniciativas para controlar a distancia las emisiones de gases de efecto invernadero mediante el uso de equipos de control de la eficiencia de los motores en sus plataformas. También está trabajando para mejorar la eficiencia de la gestión de residuos y está poniendo en práctica proyectos de reciclaje.

* Los resultados pasados no garantizan los resultados futuros

[1] Las declaraciones prospectivas se basan en suposiciones y expectativas actuales, que pueden ser inexactas, o en el entorno económico actual, que puede cambiar. Estas afirmaciones no garantizan resultados futuros. Implican riesgos y otras incertidumbres difíciles de predecir. Los resultados pueden diferir materialmente de los expresados o implícitos en las afirmaciones de carácter prospectivo.