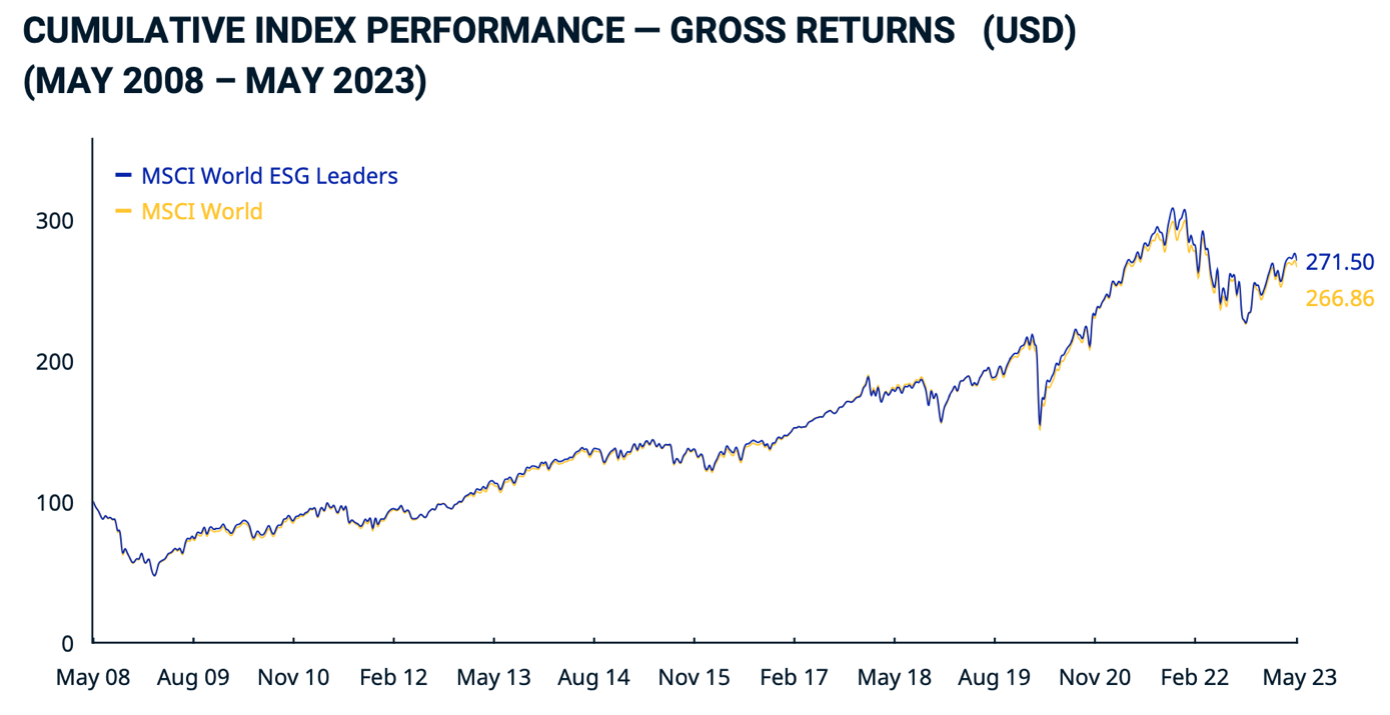

The impact of sanctions on Russia, the imbalance in supply and demand, supply uncertainty combined with rising inflation and high energy prices causing a radical rethink not only on energy policy but also on security issues and investment methods around the world appear to have put only temporary pressure on ESG investment returns in 2022. Over the past year, the MSCI World ESG Leaders Index, which consists of large- and mid-cap companies in 23 developed market countries, has delivered a gross return of 2.95 percent, while the traditional MSCI World has tacked on 2.61 percent, according to data from msci.com (data updated as of May 31, 2023). Even looking at a five-year comparison, we can see that the ESG version of the index, which is designed to represent the performance of companies selected from the parent MSCI World index based on environmental, social and governance (ESG) criteria, has a slight edge. It achieved a performance of 8.93 per cent, while the traditional MSCI World index scored slightly less at 8.34 per cent. * This data is undoubtedly key to deciding the future composition of any investor's portfolio.

Evolution of the value of the MSCI World ESG Leaders Index compared to the traditional MSCI World from May 2008 to May 2023 (Source: msci.com)*

ESG as an investment in the future

As many as 60 percent of investors report that ESG has already delivered superior returns on their investment performance compared to non-ESG equivalents, which may further drive interest in this type of investment in the coming years. * PwC's Asset and Wealth Management Revolution 2022 report estimates that ESG-focused institutional investments will see an 84 percent surge to $33.9 trillion in 2026, representing 21.5 percent of assets under management. Another factor that speaks in favor of expanding ESG investments is that, according to the aforementioned report, as many as 8 in 10 U.S. investors plan to increase their holdings in ESG products over the next two years [1].

Extension of the offer

Even with these estimates in mind, it is expected that the market could open up significantly in the coming years, expanding ESG product offerings and asset managers globally will increase their ESG-related assets under management (AUM) to $33.9 trillion by 2026 from an initial $18.4 trillion in 2021. With a projected compound annual growth rate of 12.9 percent, ESG assets are on track to account for 21.5 percent of total global AUM in less than 5 years. [2]

Europe versus the world

In terms of percentage share in Europe, at the end of 2021, 27 percent of funds had been converted to integrated ESG factors. ESG-focused AUM in the US stood at $4.5 trillion in 2021, and is projected to grow to $10.5 trillion by 2026. In Europe, it could even reach US$19.6 trillion in the same period. [3] Of course, the surge in interest is also occurring outside the EU and the US, although other regions are lagging well behind these two. However, investors are also increasing their allocations to ESG investments in Asia, the Middle East, the Pacific, Africa and Latin America, where, by comparison, ESG investments in AUM currently stand at around US$25 billion.

The bar of expectations keeps rising

There is still confusion on the market about what investors and regulators consider green and socially inclusive. On the other hand, both stakeholders are increasingly focused on supporting businesses undergoing green transformations. Financial institutions with strong ESG offerings are increasingly viewed as having a competitive advantage over those whose offerings lag in this area, and are tasked with developing portfolios that can withstand market volatility, respond to a growing set of regulatory requirements, and identify opportunities for sustainable growth that will deliver long-term results.

At the same time, expectations are rising as this segment moves forward and improves. In the EU, for example, it is no longer enough to disclose and explain major adverse impacts related to ESG factors such as greenhouse gas emissions, carbon footprint, anti-corruption measures or modern slavery to comply with regulations. More recently, companies are expected to mitigate these impacts and address the root causes of these problems.

Olivia Lacenova, principal analyst at Wonderinterest Trading Ltd.

* Past performance is no guarantee of future results

[1, 2, 3] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.