Po pandemiji vse več ljudi dela in študira od doma, zato se je povečalo povpraševanje po prenosnikih, računalnikih in pametnih telefonih. Prehod na avtomatizacijo, povečana uporaba medicinskih pripomočkov in elektrifikacija prometa, ki zahteva veliko čipov, so prispevali k manjkajočemu členu v dobavni verigi. Zaradi tega podjetja, ki se ukvarjajo z njihovo proizvodnjo, uspevajo. Delnice podjetja ON Semiconductor so se po objavi četrtletnih napovedi, ki so presegle pričakovanja, povečale za 7 odstotkov. To je pomagalo delnicam drugih podjetij za proizvodnjo čipov in zdi se, da jim bodo čipi letos zagotovili stabilne zaslužke. Uspeh čipov in polprevodnikov podpira letošnja rast delnic družbe Nvidia, ki so se povzpele na več kot 97 odstotkov.

Izvrst delnic družbeON Semiconductor v zadnjih petih letih (Vir: Google) *

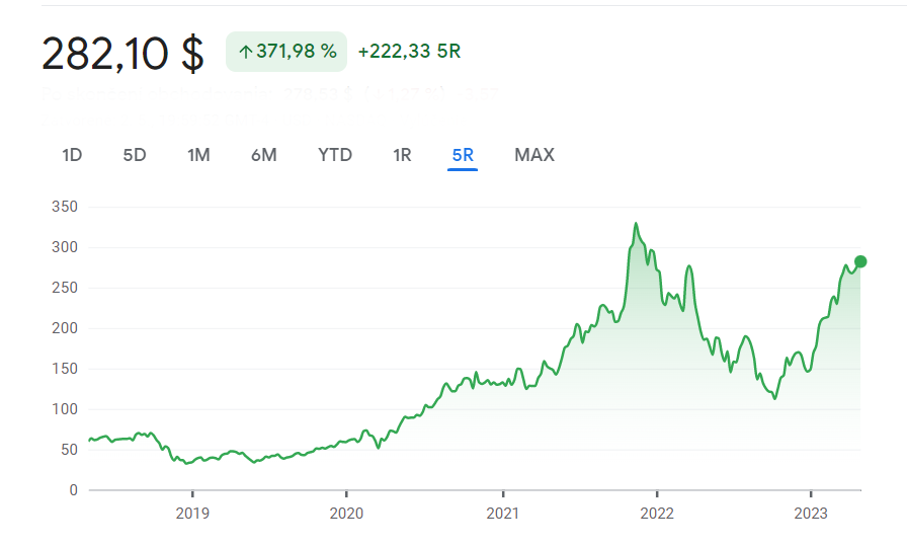

Izvrst delnic družbe Nvidia v zadnjih petih letih (Vir: Google) *

Nov igralec na trgu prihaja iz Združenega kraljestva

Britansko podjetje ARM, katerega tehnologijo uporabljajo skoraj vsi pametni telefoni na svetu, namerava vstopiti na ameriško borzo Nasdaq. Menijo, da bi lahko podjetje s prodajo delnic zbralo od 8 do 10 milijard ameriških dolarjev, kar bi racionaliziralo proizvodnjo in podjetju pomagalo bistveno okrepiti svoj položaj na trgu čipov. [1] ARM je leta 2016 kupila investicijska skupina SoftBank za takratnih 32 milijard dolarjev in ga umaknila z londonske borze. Leta 2020 naj bi za 40 milijard USD prešel v roke proizvajalca grafičnih čipov Nvidia. Ta načrtovana transakcija je bila na koncu preklicana zaradi regulativnih ovir, ARM pa zdaj vstopa na borzo. Obseg in cenovni pogoji predlagane prve javne ponudbe delnic (IPO) še niso bili določeni, vendar je vodja investicijske skupine SoftBank napovedal, da namerava ohraniti večinski delež v podjetju. Ker se je skupno število IPO na ameriškem trgu od začetka leta zmanjšalo za 22 odstotkov, saj sta borzna nestanovitnost in gospodarska negotovost odvrnili številne ponudnike, je ARM eno od redkih podjetij za proizvodnjo čipov, ki bo letos kotiralo na borzi.

Čipi kot iskano blago

Okoli 75 odstotkov tovarn za proizvodnjo čipov je na Kitajskem, Japonskem, v Južni Koreji in Tajvanu. Po podatkih družbe J.P. Morgan Research naj bi se sedanje pomanjkanje kmalu končalo, vendar bodo nekatere vrste čipov na trgu še vedno iskane. Leta 2023 naj bi se oskrba s čipi in surovinami za njihovo proizvodnjo stabilizirala, saj so temeljni dejavnik zdrave industrije. [2]

Olivia Lacenova, glavna analitičarka v podjetju Wonderinterest Trading Ltd.

* Pretekli rezultati niso jamstvo za prihodnje rezultate.

[1,2] V prihodnost usmerjene izjave temeljijo na predpostavkah in trenutnih pričakovanjih, ki so lahko netočna, ali na trenutnem gospodarskem okolju, ki se lahko spremeni. Takšne izjave niso jamstvo za prihodnjo uspešnost. Vključujejo tveganja in druge negotovosti, ki jih je težko predvideti. Rezultati se lahko bistveno razlikujejo od tistih, ki so izraženi ali nakazani v izjavah, usmerjenih v prihodnost.