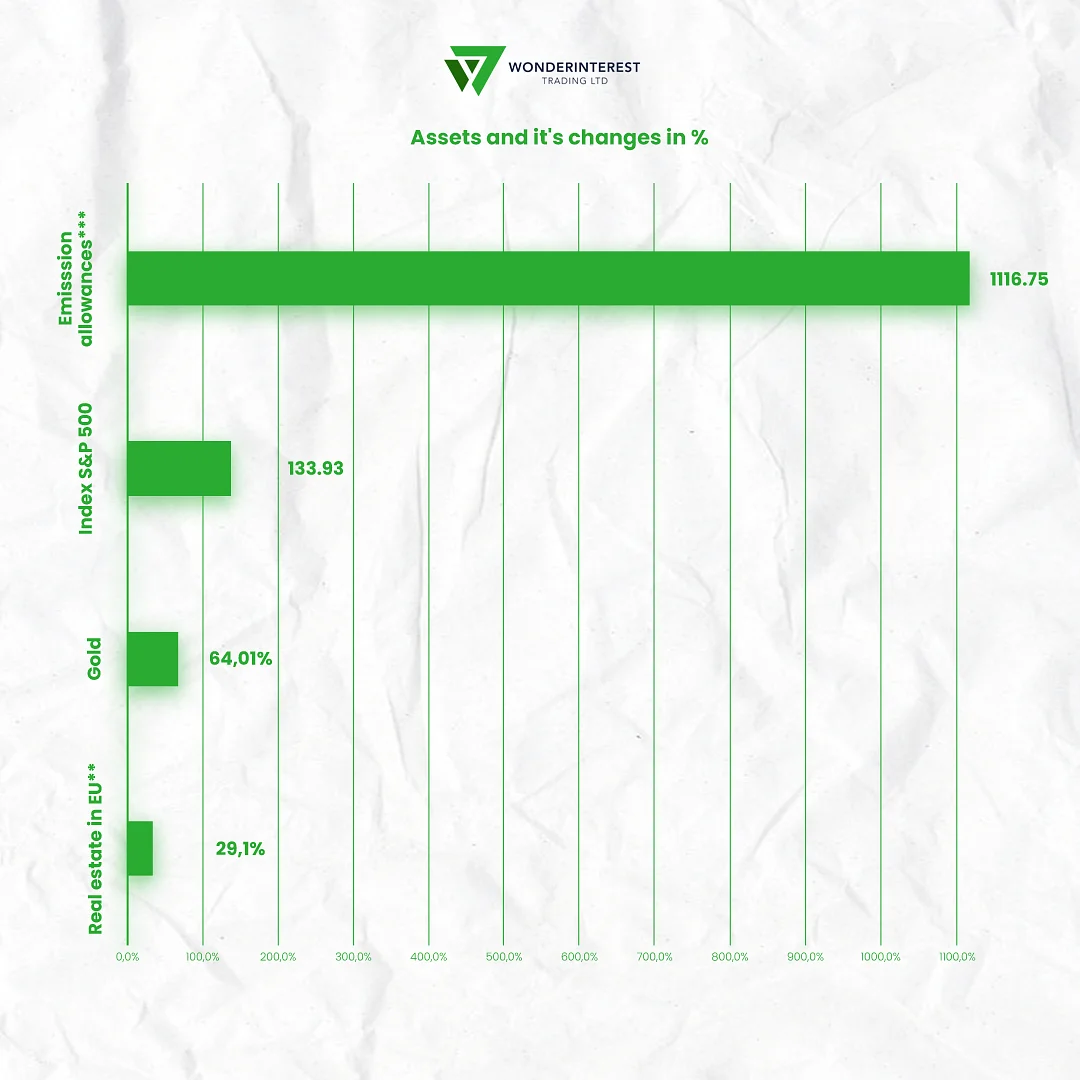

Změna ceny aktiv a emisních povolenek v systému EU ETS (v %) od 1. 1. 2016 do 10. 9. 2021

**do konce prvního čtvrtletí 2021

***9. 9. 2021

***.2021

Zdroje: Každá burza cenných papírů, Eurostat, The Economist

"Politika v oblasti klimatu dlouhodobě ovlivňuje tržní ukazatele, a proto není výrazný nárůst cen povolenek žádným překvapením," komentuje Evrula Papadopoulos, výkonná ředitelka společnosti Wonderinterest Trading. "Naše analýza se zaměřuje také na segmenty obnovitelných zdrojů, úspory energie a zdrojů, bezemisní dopravu, ale i odpovědné financování. Trh je stále přístupný vizionářům, kteří mají zájem o posun směrem k udržitelnému rozvoji," dodala.

Studie Top Green Investments 2021 zahrnuje největší světové lídry ve svých oborech, jako jsou Tesla, ABB nebo Suez, ale také nově se objevující hráče na trhu udržitelných řešení, jako je dánský Ørstednebo nebo čínský JinkoSolar. Shrnutí studie i žebříček si můžete stáhnout zde.

Wonderinterest Trading Ltd je kyperská investiční společnost (CIF) pod dohledem a regulací Cyprus Securities and & amp; Exchange Commision (CySEC) s číslem licence 307/16 a adresou sídla 176, Makariou III Avenue, Paschalis Avenue House, Agia Zoni, Limassol, Kypr.

Upozornění na rizika Nákup nebo prodej finančních nástrojů může vést ke ztrátě části nebo všech investovaných prostředků. Měli byste pečlivě zvážit, zda jakékoli investiční poradenství odpovídá vašim potřebám, finančním prostředkům a osobní situaci. Přečtěte si prosím Upozornění na rizika a varování, Zásady ochrany osobních údajů a Obchodní podmínky.

Odmítnutí odpovědnosti [1,2] Minulá výkonnost není zárukou budoucích výsledků